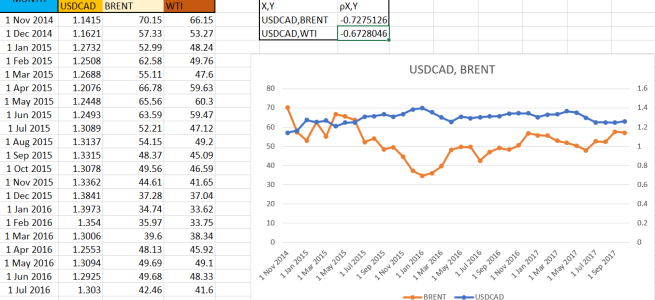

This information in this article might be slightly outdated but the gist of it still remains. During one of my presentations in the SMU EYE Investment FOREX Sub-committee I had the chance to test out the correlation between the US Dollar / Canadian Dollar Pair and crude oil (Western Texas Intermediate & Brent). Of course … Continue reading FOREX: Understanding Commodity-Pegged Currencies

Author: Nigel Fernandez

The Relationship: Volatility & 2 Indices.

We're entering the 10th year of the stock market bull run. Equity valuations are arguably "over-priced". The US economy is starting to show good strength, inducing the central bank to push the interest rate lever upwards. It is very likely that we will see several rate hikes in the ensuing periods of this year, but … Continue reading The Relationship: Volatility & 2 Indices.

3 Ways To Blow A FOREX Account

Risking more than 2% per trade “Go hard or go home”. This phrase is being passed around everywhere today. Sounds apt in the gym, but not so much in trading. Many novice traders are guilty of risking a significant amount of their account in any one trade. Trading is a game of probability and randomness … Continue reading 3 Ways To Blow A FOREX Account

Track savings instead of spending.

In an attempt to exercise financial prudence, it is common for most of us to create a budget for expenses. While there are personal finance apps out there to help you out, tracking expenses and keeping within budget can be an arduous process, week after week. For expenses, I only record big ticket items that … Continue reading Track savings instead of spending.

Are you a Trader or Investor?

This article was written in partnership with ShareInvestor, a financial internet media & technology company that owns one of the largest investor relations network in Asia. Trading vs Investing People often confuse trading and investing; many use them interchangeably. However, these 2 ways of making money in the market are actually very different. Whether you’re more … Continue reading Are you a Trader or Investor?

4 must-set NEW YEAR RESOLUTIONS in 2018!

It's the time of the year, and if you're like most, you'll probably be setting big goals to achieve for the new year ahead. We all like a fresh new start to things - it brings us hope and new possibilities. But another year will pass, much like how we're already in week 52 of … Continue reading 4 must-set NEW YEAR RESOLUTIONS in 2018!

China Forex Expo 2018 is back on May 18th-19th

China Forex Expo 2018 is back on May 18th-19th After a huge success of the 6th China Forex Expo 2017 with a massive turnout of over 6,000 potential partners and high-end clients and over 50,000 hits and 600 reviews of the live streaming of the conference, China Forex Expo 2018 is back again for all … Continue reading China Forex Expo 2018 is back on May 18th-19th

Getting your feet wet in investing

*This is not a sponsored post and we are not making any investment recommendations. Please do your own due diligence before making any investments. Please read the full disclaimer on the right column of this page* As I am writing this article, I am very thankful of all the experiences I have gotten from the … Continue reading Getting your feet wet in investing

CapitalistLAD Joyful Christmas Guide

**THIS IS NOT A SPONSORED POST** As we usher in the season of joy and giving this fall, let us not forget the importance of keeping to prudent financial habits. In fact, Christmas doesn’t have to be an expensive occasion. Here are some easy-on-the-wallet festive tips the lads here would like to share with you. … Continue reading CapitalistLAD Joyful Christmas Guide

Liquidation?! Who’s got your money?

In each trading day, billions of shares are being traded on stock exchanges around the world. With screens flickering at the tick of every price change, market participants actively buy and sell shares in a bid to make a profit. Traders would think about risks associated with macroeconomic and geopolitical news events that may change … Continue reading Liquidation?! Who’s got your money?